Ending Our Vulnerable Position: The Return Of Black Electorate Economics University (BEEU)

There has never been a time when I personally, or we at BlackElectorate.com, have received more questions from our viewing audience regarding business, economics, and finance. The questions have touched on President-Elect Obama’s economic advisers; the history of wealth-creation among Chinese, Jewish, Italian, and West Indian communities in America; the changing music industry business model; how to finance a business without bank loans; the possibility of U.S. securities losing their triple-A ratings; whether capitalism is dying out or not, to be replaced by socialism; addressing Black male unemployment; what books to read to get a basic understanding of economics; and so much more.

In addition to these questions have come inquiries regarding Black Electorate Economics University (BEEU)(http://www.blackelectorate.com/out/sel_lesson_out.asp) and when it might return, perhaps to address some of these questions.

Our answer has always been that we were confident we would offer BEEU again, but not quite sure when.

With the enormous interest, and rapidly changing local, national, and global circumstances we have decided that the time is right to offer two additional Semesters that will inform, educate and empower people at an increasingly critical and difficult time period.

One of the most important distinctions for any of us to make regards knowledge, the nature of it, its different forms, and which forms are the most important to know. This is especially important during this time period, and as it relates to economics.

Before presenting the upcoming curriculum for BEEU, there is an important point to make regarding, knowledge and information.

From Renewing Governance: Governing by Learning in the Information Age by Steven A. Rosell we read:

- data are unrefined ore, undifferentiated facts without contexts;

- information is refined ore, organized data, but data that we have not yet internalized (the newspapers we have not yet read, the course we have not yet taken);

- knowledge is information that we have internalized (integrated with our own internal frameworks.)

Building on the above, there are various forms of knowledge, with some more relevant than others, which form the basis of understanding, and then wisdom.

Most of us are improperly revolving around information, especially on economic matters.

Information is more of an external or superficial phenomenon, while knowledge involves the internalization of information with an awareness of its factual nature. Understanding revolves around the meaning of knowledge, and wisdom is the application of what you understand.

Learning revolves around conversation, observation, reading, and experience (which always involves suffering). To place greater emphasis on spiritual and unseen processes of learning, one could add revelation and intuition, but that could be a qualification of the previous four methods as much as it would be a fifth category of learning.

One of the factors that all of us - particularly those who have been oppressed though miseducation - must be careful of, is the degree to which we increasingly rely upon exposure to information sources in the form of news media, as our primary means of learning. There are too many of us that are not making the distinction between data, information, knowledge, understanding, and wisdom, and media outlets take advantage of this, and profit from it.

In this critically and increasingly dangerous time for human beings of all colors - in the streets or in the suites - to be misinformed can be fatal, or at least it can cost you a lot of money, as we are all observing (smile).

Now, a final point on how this pertains to our everyday economic lives, how we are all victimized, and why BEEU is designed the way it is.

To make this point, I quote something from a book I learned about through another book, This Is The One by Jabril Muhammad. What follows was published in 1966. Apply them to all of us today.

In The Vulnerable Americans, Curt Gentry wrote:

For better or worse, the climate affects our thinking, our mood, and our acts. The climate of fraud which overcasts America today, so touches every part of our lives that, except in extreme circumstances and election years, we are inclined to take it for granted.

The condition is not new. What is new is its extent. During the nineteenth century, when immigration was high, education low, and opportunity waiting just around each corner, sociologists estimate that probably one out of every ten adult Americans fell victim to a swindle or fraud during his lifetime. Times have changed. Americans have grown wiser, more sophisticated, less gullible, and alas, perhaps even less imaginative. Today, ten out of ten adult Americans are victims of swindles and frauds, not once or twice during their lifetimes, but almost every time they make a purchase, cast their votes, pay their taxes, invest in the future, seek happiness, entertainment, or love. Never before in the history of the United States have so many been swindled so often in so many different ways out of so much – with so few protesting voices.

We offer the 2009 Semesters of BEEU, which begin on December 17, 2008, to confront this reality - our individual and collective vulnerability to financial and business fraud, as a result of misinformation and inadequate leadership on economic matters.

The goal is to move one from intellectual discussion and information overload on economics, into a framework and applicable knowledge that empowers us in political, cultural, and financial decision-making.

Semester One is dedicated to explaining important – basic and more complex – local, national, and international economic realities, while Semester Two is designed to take one deeper into the life activity of business.

Here is a description of Semester One:

Lesson 1: The Root Cause Of The Financial Panic of 2007-2008 And The Difference Between Finance and Economics

Date: Wednesday, December 17, 2008

Description: While information abounds, there are a few aspects to the mortgage meltdown and systemic collapse of the banking system that were ignored or which deserve further attention. In this Lesson Cedric Muhammad tells how this all started 35 years ago, and why the world may be headed for another Great Depression because of it. The difference between finance and economics is made clear.

Key Reference: The October 9, 2008 edition of The Diane Rehm Show “The International Response to the Financial Credit Freeze” and “The Future of American Capitalism.” Available online at: http://wamu.org/programs/dr/08/10/09.php#21985)

Lesson 2: The Economic Cabinet Of The President, In Recession and Depression

Date: Wednesday, January 21, 2009

Description: A review of the economic advisers surrounding President Barack Obama, their background and ideology, and their likely impact on U.S. fiscal, monetary, and trade policy. Are their hidden business interests behind the throne of every President, calling the shots? What should the new President learn from past administrations in Recessions and the Great Depression? This lesson compares the incoming administration to previous Presidential Cabinets. It also looks at the in-fighting that takes place among economic advisers, key White House power centers - including the National Security Council - and other branches of government.

Key Reference (s): "The Presidency Of Herbert C. Hoover" by Martin L. Fausold; No Ordinary Time: Franklin and Eleanor Roosevelt: The Home Front in World War II by Doris Kearns Goodwin; JFK: The CIA, Vietnam and the Plot to Assassinate John F. Kennedy by L. Fletcher Prouty Nixon's Economy: Booms, Busts, Dollars, and Votes by Allen Matusow;The Price of Loyalty: George W. Bush, the White House, and the Education of Paul O'Neill by Ron Suskind; Secrets of the Temple: How the Federal Reserve Runs the Country by William Greider; "Oval Office: Stories of Presidents in Crisis from Lincoln to Bush" by Nat May (Editor) Clint Willis (Editor)

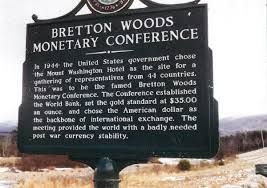

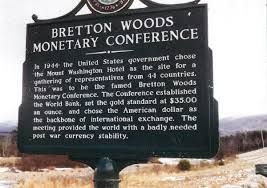

Lesson 3: Bretton Woods II: Toward A New Global Monetary System

Description: The recent G-20 Summit was only a preview of what we can soon expect – a repeat of the historic 1944 international monetary conference in Bretton Woods, New Hampshire, where a global financial arrangement was made around a gold exchange rate system and where a single world currency was mentioned. The Panic of 2007-2008 has produced a problem and crisis that only a unified effort of the world’s top economic thinkers world’s central bankers, finance ministers, and treasury securities can address. This lesson goes over the history of Bretton Woods, and points to the future - key figures to watch, and possible alliances and debates.

Date: Wednesday, February 4, 2009

Key Reference: The Way The World Works by Jude Wanniski

Lesson 4: Establishing The United States Of Africa, Under A Single Currency, Backed By Gold

Date: Wednesday, February 18, 2009

Description: The effort to unite the nations of Africa, politically, culturally, and economically is now reaching a critical stage where the subject of a single currency must be addressed. The African Union’s current approach to a single currency is critiqued and a plan to get Africa to a single currency, backed by gold is presented

Key Reference: “‘As Good As Gold:’ An African Single Currency;” November 14, 2008 paper presented by Cedric Muhammad to the African Union.

Lesson 5: Risk and Insurance: From Wall Street To Las Vegas To The World Of Religion

Date: Wednesday, March 4, 2009

Description: Reuven Brenner’s new book (co-authored by Gabrielle A. Brenner and Aaron Brown) is the focus of this lesson of which Henry G. Manne, Dean Emeritus of George Mason Law School writes: “Did you know that the modern insurance industry is a direct outgrowth of gambling? Did you know that poker provided one of the most important sources of capital for penniless Western frontiersmen in the United States? Did you know that major opera houses of Europe began as gambling halls with the theaters attached (history, if not always the quality of music, repeats itself in Las Vegas)? Do you know the real reason the NFL resists the legalization of sports betting in America? For the fascinating answers and insights into the politics, the finance, and the economics of that over-maligned pastime, gambling – and yes, including the surprising role it has frequently played in finance – read A World Of Chance.” This lesson takes a look at what divides and unites religion and business on the subject of gambling, risk-taking and insurance.

Key Reference: A World Of Chance: Betting On Religion, Games, Wall Street by Reuven Brenner, Gabrielle A. Brenner, and Aaron Brown

Lesson 6: The Five Sources of Capital, the African Independence Movement and The Birth of Organized Crime In Black America

Date: March 11, 2009

Description: Reuven Brenner’s seminal five sources of capital thesis maintains that there are three sources of capital – inheritance, capital markets, and savings, and when the first three are unavailable, people turn to a fourth and fifth – government and crime, respectively. This lesson connects two unique events – the independence movement in Africa in the 1950s, 60s and 70s, and the emergence of organized crime in Black America in three cities, to test the insight of this thesis. It is the kind of mixture politics, culture and economics that is unique to BEEU.

Key Reference: Force Of Finance by Reuven Brenner, The Science of Business by Cedric Muhammad

Lesson 7: Building Wealth Through Ethnic Networks, Rotating Credit & Savings Associations and Investment Clubs

Date: Wednesday, March 25, 2009

Description: What is the secret to the wealth of immigrant communities in America? Internal unity and indigenous pools of capital, this lesson states. Whether it is the Jewish community, Chinese, Italian, Irish, Indian, or West Indian or West African community, the principles are universally applied. BEEU incorporates these lessons and applies them to the popular phenomenon of investment clubs

Key Reference: Unpublished Excerpt: The Science of Business by Cedric Muhammad

Lesson 8: Banking 101

Date: Wednesday April 8, 2009

Description: What exactly is a bank? What is the fractional reserve banking system? What is the difference between the capitalization of a bank on one hand, and its liquidity on another? How has the Panic of 2007-2008 altered the business model of banking? How does the Western banking system compare to that of others, including the emerging world of Islamic finance? This lesson drills down on the fundamentals of banking with an eye toward the trends and changes to the industry on the horizon.

Key Reference: Interview Of Robert Patrick Cooper, Senior Counsel, OneUnited Bank (http://www.oneunited.com/)

Lesson 9: Investing In Financial Markets 101

Date: Wednesday, April 22, 2009

Description: What should one consider as they invest in stocks, bonds, currencies and commodities? Can money still be made in a global economic slowdown? How can one connect formal investing in capital markets with informal cooperative economics practiced on a neighborhood and personal network level? This lesson offers answers from a unique and experienced professional – who puts money to work on Wall Street, in the local neighborhood, and around the world.

Key Reference: Guest Lecture – Glenn C. Williams, Foundation Investments Group (http://www.foundationllc.com/)

Lesson 10: Personal Finance: Savings, Credit, Spending and Debt In A Falling Economy

Date: Wednesday, April 29, 2009

Description: When looking at strategies for personal finance you don’t just want to know how to make money, you want to know how to address credit repair problems such as: foreclosures, collections, repossessions, bankruptcies, student loans, judgments, late payments and more. Could the key to so many problems be basic principles and strategies related to saving and spending? This lesson indicates so.

Key Reference: Guest Lecture – Harrine Freeman, Author How to Get Out of Debt: Get an "A" Credit Rating For Free; H.E. Freeman Enterprises Credit Repair Counseling and Personal Financial Services (http://hefreemanenterprises.com/)

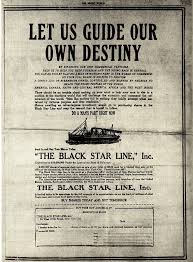

Lesson 11: An Analysis Of The Economic Programs of The Honorable Elijah Muhammad and The Honorable Marcus Garvey

Date: May 6, 2009

Description: Did integration undermine the economic strength of Black America? Is Black economic nationalism a thing of the past or only an ideological-rhetorical construct with no real application? Is Black community development only possible with the help of Wall Street and government programs? This lesson considers the two greatest examples of indigenous economic development in the history of Black America – the economic blueprint of the leader of the Nation of Islam, the Honorable Elijah Muhammad, and the program of the leader of the United Negro Improvement Association (UNIA), the Honorable Marcus Garvey. For years the similarities and differences between these two histories have been debated. This lesson refers to little-known history in an effort to end superficial romanticism in support of both programs, and to counter wicked propaganda leveled against them. Whether both programs might provide a viable economic model in a global economic slowdown is explored and discussed.

Key Reference: Unpublished excerpts: The Science of Business

Lesson 12: Improving Black America's Capital To Labor Ratio

Date: May 20, 2009

Description: In this course finale the subject of the relationship between unemployment and incarceration rates; savings, stock and home ownership rates; and the size of Black-owned small businesses reveal the economic health of Black America. The insight points to a mix of regulatory and fiscal policies that can help address economic development and growth. In this lesson empowerment zones, access to capital, renewal communities, tax policy and barriers to business and capital formation are analyzed, and an agenda outlined for positive change.

Key Reference: "Riot or Renaissance?: Black America’s Capital to Labor Ratio," by Cedric Muhammad

Each Lesson at BEEU Class Of 2009, Semester One, is delivered in audio form with a question and answer format via e-mail or conference call. Students receive recommended readings related to each lesson. Special chat sessions enable students to chat with one another regarding course material.

All Students registering before Wednesday, December 10, 2008 receive an exclusive BEEU Memo: “20 Economists You Should Know and Why”

****

Enroll Today!

http://www.blackelectorate.com/out/sel_lesson_out.asp

Cedric Muhammad Sunday, December 21, 2008 To discuss this article further enter The Deeper Look Dialogue Room

The views and opinions expressed herein by the author do not necessarily represent the opinions or position of BlackElectorate.com or Black Electorate Communications.

|